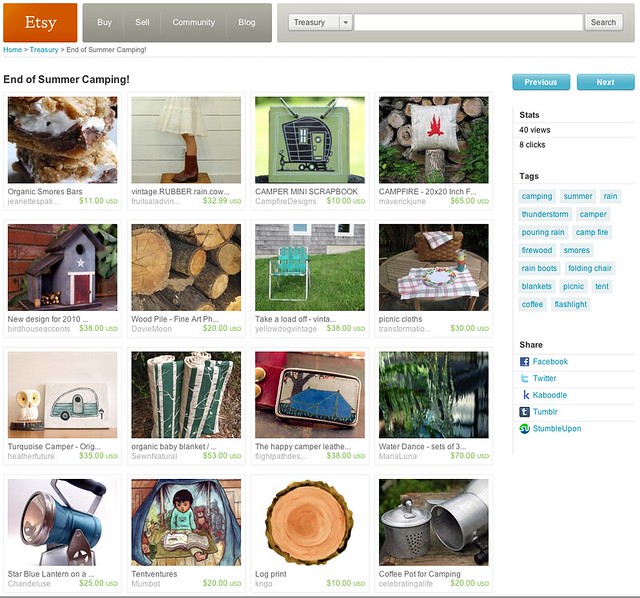

Photo of etsy page by freshflapjax via Flickr

In 2012, artisans on Etsy sold a combined $895.1 million worth of goods and supplies. This was a 71 percent increase over 2011 sales figures, Etsy CEO Chad Dickerson noted on the company blog. Etsy’s 2012 membership totaled 22 million, with 800,000 active sellers.

As Etsy sellers know, you can download CSV files of sold orders and fees paid directly from the site. While this helps with seller inventory management and record-keeping, it doesn’t translate to easy tax filing. As the holiday season — a crunch time for many Etsians — approaches, try these online tools to simplify tax season preparation and record-keeping:

Online tax season resources

There are a range of online filing platforms, including H&R Block and TurboTax from Intuit, which also offers payroll taxes and accounting software. In addition to those resources, the following websites offer tax advice geared toward small businesses like yours:

- IRS Small Business and Self-Employed Tax Center: If you don’t want to hire an accountant to do your Etsy shop taxes, this can be a great resource. The IRS can walk you through business tax credits, quarterly self-employment taxes , home office deductions and more.

- Etsy Blog: Etsy’s blog periodically posts tax information and offers a useful “Taxes 101” overview that gives new sellers a walkthrough on tax issues. It can be a useful refresher for veteran sellers as well.

- SBA.gov: SBA.gov, the Small Business Administration site, offers advice on everything from business marketing to taxes. Useful resources here include an overview of small business state and federal tax obligations, tips on collecting sales tax over the Internet and special tips for sole proprietors. The community forum allows business owners to crowdsource advice. You may find that other business owners share the same tax dilemmas as you, and can use the forum as a sounding board.

Apps that help

iPhone and Android users can use these apps to stay organized or find answers this tax season:

- Shoeboxed: Keeping track of paper receipts is challenging, especially if you order most of your supplies online and only do craft store runs when you run out. Use free iPhone or Android app Shoeboxed to handle receipts. Simply scan from your phone and store the receipt forever. Log in to Shoeboxed.com or use the app to view saved receipts, or export to Excel for maximum ease of tax-season reporting.

- Dictionary of Tax Terms: If you don’t know depreciation from amortization, the $3.99 Dictionary of Tax Terms can help. The app defines more than 600 tax terms, and was created by a University of California professor. If you have a tax filing app, such as SnapTax from Turbo Tax or H&R Block Tax App, you may be able to find some term definitions in there as well.

- Bloomberg BNA’s Quick Tax Reference App: If you use your car for business errands or itemize your deductions, this free Bloomberg app offers up-to-date reimbursement rates and tax information. While most of the information doesn’t apply to small businesses, it can still be a good tool for Etsians doing their own taxes.